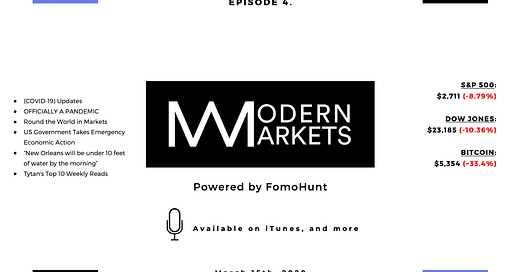

Modern Markets Episode 4 - Part (1/2): W.H.O. - OFFICIALLY A PANDEMIC and the US Government Takes Emergency Economic Action

Pandemic Edition

We continue to cover the COVID-19 outbreak as it is the largest catalyst for nearly every market move this month. Due to the length restrictions of Substack, we will be releasing this newsletter in 2 parts.

Coronavirus (COVID-19) Updates

Stats via Johns Hopkins

Confirmed Cases - 156,062

Total Deaths - 5,817

Total Recovered - 72,606

OFFICIALLY A PANDEMIC

The coronavirus is officially a pandemic. After infecting over 100,000 people worldwide, the World Health Organization has labeled it a “global outbreak” on Wednesday. Originally reported in China, the coronavirus has spread worldwide, infecting celebrities like Tom Hanks and government officials including Brazil's Press Secretary, Fabio Wajngarten.

To date, the most affected countries are currently:

China - 80,976 cases

Italy - 21,157 cases

Iran - 12,729

South Korea - 8,086

Spain - 6,391

In response, India has stopped issuing tourist visas and closed its border with Myanmar. Schools and colleges are shutting down in Ireland and the US, and the NBA has suspended its current season. Several companies, including Amazon, are urging employees to work and stay at home if possible.

In short, the world is finally waking up to the severe infection rate of COVID-19.

This newsletter is incorporated into the Weekly Modern Markets Podcast available on iTunes, Spotify, Anchor, and Stitcher.

Round the World in Markets - It’s Not Good

North America

The coronavirus continues to devastate the financial markets.

The S&P 500 is down over 20% from the highs of late February. On Thursday the market halted trading due to the rapid drop in the financial markets.

(Image Courtesy of: https://www.foxnews.com/us/steps-trump-taking-to-fight-coronavirus)

On Friday Trump spoke in the White House rose garden to a group of reporters, declaring a national emergency. He promised to “Unleash the full power of the federal government” to combat the spread of the disease and access over $50 billion of emergency funds to do so.

There are a number of initiatives that will be enacted. Every State will set up emergency operation centers. Hospitals are being asked to activate their emergency preparedness plan to prepare for the influx of patients. All hospitals will be given maximum flexibility to respond to patient care, which includes waiving laws to allow telehealth visits. Federal license requirements that limit hospital beds will also be waived and hospitals will be allowed to onboard as many physicians as needed.

The President also claimed that Google would be working with the government to create a website that would allow users to screen their symptoms against the coronavirus; this has been proven false.

“No resource will be spared, none whatsoever”

The President appears to be pulling no punches to right the financial markets, which rallied during the press conference. President Trump stated that interest on all outstanding student loans would be canceled for the time being and that the low cost of oil would allow the US to fill its reserves “right up to the top.”

In the same press conference, the President announced the FDA had approved a new test for COVID-19 and would be making half a million tests available next week. Representatives from several Fortune 500 companies including Target, CVS, Walmart, and Walgreens made statements pledging that they would increase their stock of sanitizing products and that COVID testing would be available in their stores.

European Union

A group in France has defied recommendations and formed the largest Smurf rally in the world. Over 3,500 gathered in Landerneau, France in blue body paint and costumes to break the record. In a Twitter post, a video of the gathering shows one of the participants saying “It was more important, the coronavirus is no big deal, it’s nothing.” The event took place days before the country banned gatherings of over 1,000 people. France currently has 2,882 confirmed COVID-19 cases.

Middle East

Amid the coronavirus situation, political tension in the Middle East is on the rise. Troops from the US have begun to engage with Iran-backed Shia forces. Two aircraft carriers, the USS Dwight D. Eisenhower and the USS Harry S. Truman are stationed in the area. General Frank McKenzie spoke at the Pentagon last week stating that this is the first time since 2012, following 9/11, that an extended dual-carrier operation has taken place in the region.

US Government Takes Emergency Economic Action

(Image courtesy of: https://www.politico.com/news/magazine/2020/03/12/trump-coronavirus-misinformation-127513)

On Wednesday President Trump addressed the nation in a televised announcement on the economy. He revealed that a new stimulus plan was being pushed forward to counteract the economic impact of the coronavirus. The proposed plan is extensive and consists of a number of large tax cuts and other initiatives to help consumers and businesses remain operational.

Tax Cuts

The call has been made to eliminate all Social Security payroll taxes nation-wide until the end of the year. The current tax rate is 6.2%. with a potential price tag of $700 billion. Self-employed workers would no longer pay the 15.3% self-employment tax. These tax breaks come at a time when Democrats are trying to pass their version of a stimulus package.

Emergency Leave Benefit

A new leave fund would be established that pays two-thirds of a worker’s average monthly earnings. The time away from work would need to be 14 days or more, and be directly related to the virus.

Free COVID-19 Testing

Currently, the cost of testing for the coronavirus is upwards of $1,300. Today the CDC was publicly pressured to offer the testing for free. Trump's proposed plan would cover all private and public insurance providers to cover the cost of the test and related doctor visits.

While the short term effects of this bill may indeed allow workers and companies to keep more of their post-tax paycheck, it would end at the end of 2020. In total the size of this stimulus package is enormous, topping out at $1 trillion. If approved, this would be the largest stimulus package in US history, larger than the bank bailout of 2008. In 2019 Finance Professor J. Lucas of MIT Sloan calculated the Bank Bailout of 2008 to cost $498 billion.

It is curious that while there was a great deal of outrage and criticism towards the Obama administration’s decision to bail out the banks in 2008, there is not much directed towards this current stimulus plan. Probably because in this crisis there’s a run-on toilet paper.

Concurrently, the Federal Reserve is taking action to provide additional monetary aid to the nation.

Save Us, Federal Reserve!

This week the Fed made the announcement that it would be making $2 trillion available to help calm down the market. This is not a gift to the American people. This funding would be made available primarily for short-term lending and the purchasing of government bonds (US Treasury Bonds). The New York Fed justified this move by stating “These purchases are intended to address highly unusual disruptions in the market for Treasury securities associated with the coronavirus outbreak.”

Treasury bonds, while not the most exciting financial product, are a keystone of financial products in the US. They are considered “risk-free” assets and directly related to investors’ confidence that the US will be able to pay off its national debt sometime in the future. It is this trust upon which the modern financial system is based.

The national debt is currently over $23 trillion; Twenty Three Trillion Dollars.

On a more practical level treasury bonds are used as the underlying basis for Certificates of Deposits (CD’s), mortgages, and money market accounts. These are, in turn, used as a basis for other financial vehicles including ETFs, derivatives, and pension funds. In short, if the bond market is in trouble, everyone is in trouble.

Keeping the bond market afloat is fundamentally important to market stability. If the trading of the bond market dries up, it will have a rippling effect throughout the global economy, potentially signaling another financial crisis akin to 2008. Speaking on the subject, Tom di Galoma of Seaport Global Holdings stated "Market-making is under severe pressure. This is beyond the market’s current capabilities.” It is still unknown if the effects of these efforts will be enough to curtail the markets’ fear about the coronavirus. The Fed has two main tools of encouraging market growth, either lowering interest rates or injecting capital into the market. Both of these tools were used within the span of a few days.

The Hill is reporting that another cut in the Fed interest rate is expected after it’s March 17-18 scheduled policy meeting. The current Fed rate is at a historic low of 1.25%. President Trump has been very vocal in calling for a rate “comparable to their competitor Central Banks.”

Both the European Central Bank and Japan currently have negative interest rates, but Frederic Mishkin, the former Federal Reserve Governor does not feel this is the solution. In speaking to CNBC on Friday he stated “Monetary policy is limited in its ability to deal with this kind of shock,” adding “This shock is not as existential or as serious in one sense . . . eventually, we’re going to be able to control this crisis. The issue now, it does seem to be spinning out of control . . .”

Despite the 9% recovery the stock market experienced on Friday, the crisis is not over. Volatility remains at a record high, more COVID-19 test kits being disbursed next week means more confirmed cases and potential overcrowding of hospitals. As the number of cases increases there will likely be a narrative that the virus is “spreading” more, or it has become “more infectious,” when in reality those already infected are simply being identified. Expect to see more headlines covering shortages of: hospital staff, medical supplies, hospital beds, and toilet paper. Always with the toilet paper.

The steps late this week may dampen the severity of the virus’s effects, or flatten the curve, but the road to recovery is still long. Best to prepare accordingly, especially if there is a further drop in the markets come Monday.

Tytan’s Top 10 Weekly Reads

FED Injects $500 Billion into the financial system

Trump Declares National Emergency

China sees more recoveries than incoming cases

Trump waives student loan interest payments

Trump expands travel ban to the U.K. and Europe

Drive through tests will be administered by using the private sector

The last time the markets reacted like they have was in 1929

The market cycle is broken now and will take time to repair

Bill Gates resigns from Microsoft Board of Directors

FED Fails to ease dollar shortage

Stay Tuned for Part 2…

This newsletter, analysis, research, and commentary provided by Modern Markets, lead analyst Kaltoro, with contributions from TytanInc and Digital Lawrence and does not constitute financial advice. The publication incorporates data from numerous sources including, but not limited to, CoinMarketCap, Bloomberg, CNBC, Lunar Crush, and the team at FomoHunt.