Coronavirus (COVID-19) Updates

New Case via “Community Spread”

A California resident has been diagnosed with the coronavirus at UC Davis after being infected through “community spread,” NPR reports. Community Spread is the term used for a person contracting a disease without traveling or leaving their home country. As the patient had not left the country lately, the diagnosis was delayed for 3 days as the CDC did not feel it necessary to screen for the disease.

UC Davis has issued a statement stating that "UC Davis Health does not control the testing process." They later added "We requested COVID-19 testing by the CDC since neither Sacramento County nor CDPH [California Department of Public Health] is doing testing for coronavirus at this time. Since the patient did not fit the existing CDC criteria for COVID-19, a test was not immediately administered.”

Prevention

The continued spread of the coronavirus has driven some individuals to stock up on supplies. While countries including China and Australia have instituted strict quarantine policies, the US has yet to sound such an alarm or enact curfews. This has not, however, prevented a physician close to the author from purchasing non-perishable goods including rice, beans, canned chicken, and dried cereal.

Rather than panic or ignoring the problem, the Center for Disease Control (CDC) recommends specific steps to prepare for a potential outbreak of COVID-19. Most of these steps are within reason and are the same if preparing for an earthquake, hurricane, or other national disasters. And no, the coronavirus does not come from the Corona beer.

Good Lord, people.

Helpful Idea 1 - Get ‘dem Meds

Make sure you have enough medication to last a few weeks. If you are getting low on Xanax, be sure to fill up. The last thing anyone needs is to have a panic attack if panic actually ensues. Over the counter medications also qualify, i.e. Advil, Tylenol, Aspirin, or anything else that might be in short supply. Probably not a bad idea to have free cash on hand while you’re at it.

Helpful Idea 2 - Traditional “Feel Good” Remedies

While not a deterrent or cure for COVID-19, Edith Branch-Sanchez of Columbia University Medical Center recommends having non-perishable foods that double as “feel good” foods traditionally eaten while sick. Chicken soup, crackers, as well as plenty of water or Pedialyte are recommended and will make the symptoms of the coronavirus more tolerable. Remember, most confirmed cases have mild flu-like symptoms.

Helpful Idea 3 - Scrub Down

While we should already be washing our hands several times a day, the transmission of the coronavirus makes it all the more important. Properly cleaning your hands will not only keep you from contracting the virus but will keep those close to you from getting it as well. Current evidence suggests that the virus is spread through droplets, commonly expelled from a cough. It’s probably a good idea to wash your hands whenever you get home, to the office, or any other building with a restroom. In case you forgot how to wash your hands (which they teach in kindergarten), the World Health Association provides a quick review.

And if you want to get creative, feel free to make your own hand sanitizer.

Helpful Idea 4 - Mask Your Face

Facemasks have gotten by far the most attention in the popular media. In fact, up to a few days ago, there was no consensus as to how the virus was spread. As a result, home remedies and make-shift masks have been popping up all over the internet, including ones for dogs.

Please do not mask your dogs.

The CDC recommends a face mask with an N95 or N99 rating. These masks are designed to prevent droplets containing the virus from being inhaled by those nearby. Note the large “N95” in the middle of the mask. When worn right, these masks are designed to keep out particulates. As a side benefit, these masks keep you from touching your face, which is about 15.7 times an hour.

If it seems like these precautions are common sense and less drastic than building an underground bunker, you are correct. Aside from the drastic measures China appears to be taking, everyday life in the US and other countries seems to go on unabated.

Mortality Rates of Comparable Diseases

SARS - 10%

COVID-19 - 3.4%

Measles - 3%

Flu - 0.05%

From the looks of it, the coronavirus is less deadly than SARS. CNBC reported in late January that while the mortality rate was less than SARS, COVID-19 is more easily spread. Despite these lower mortality rates, the mainstream media is obsessed with its transmission.

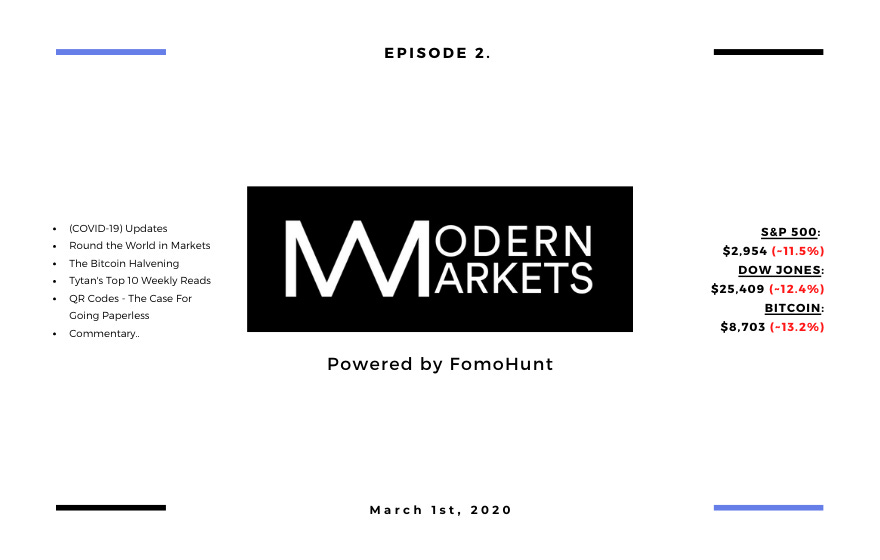

Round the World in Markets

North America

The coronavirus is showing strength as it continues to spread globally and the markets have taken notice. The international markets are down with massive pullbacks across the board. Gold is the only asset that seems to be somewhat immune at the moment, as investors move to risk-off commodities.

South America

Infosecurity magazine is reporting an increase in cybercrime. These scams are targeting retail, banks, and the hospitality sector in an attempt to collect information through phishing attempts. Aside from Brazil, which has over 40 data privacy regulations, the rest of Latin America seems woefully unprepared for a coordinated attack via organized cyber-criminals.

European Union

The EU is considering sanctions against the Chinese and Russia. This comes on the back of the EU's newly established cyber sanctions regime. Primarily designed to tackle attacks originating outside of the EU, the cyber sanctions regime will be able to enact travel bans, freezing of assets, and denying payment methods to bad actors.

SE Asia

Microsoft may be expanding its data centers into Indonesia. Following the country's promise to enact new regulatory changes, President Joko Widodo related that "Microsoft wants to invest immediately in Indonesia," and "So within a week we will decide a new, simple regulation to support the investment.” While there are no details on the actual arrangement or scope of the investment, Microsoft is not letting the coronavirus stop its forward progress.

Middle East

The United Arab Emirates (UAE) is seeking billions of dollars in loans. Abu Dhabi is seeking $2 billion in international loans. While the UAE is not hurting for money, Middle East Monitor states that this move makes sense as the country strives to tap new sources of liquidity.

The Bitcoin Halvening

Before the coronavirus reared its anti-biotic resistant head, the talk of the past several months in the Cryptocurrency Community has been the upcoming Bitcoin Halvening.

Who With the What Now?

The Bitcoin Halvening is an event that takes place approximately every four years, in which the Bitcoin reward drops in half. That is, there are half as many Bitcoins created after each halvening event.

When Bitcoin was first created, 50 Bitcoins were created every 10 minutes. As computers on the network validated each transaction in the background, these participants were given 50 Bitcoins for their use of electricity and processing power. In 2012 the first halvening occurred, and the reward dropped to 25 Bitcoins. Then in 2016, the second halvening took place, and in April/May, the third halvening will further reduce the supply of new Bitcoins put into the market. Only 6.25 Bitcoins will be created every 10 minutes after that until the next halvening when only 3.125 are created.

If this is sounding strange, it is. Part of Bitcoin’s design is based on a deflationary model, that is, the amount of newly created digital currency goes down over time. Modern monetary policy dictates that the supply of currency only goes up. We see this not only in the amount of new money created as debt but in the US actions taken towards quantitative easing and the Federal Reserve Rates. While this article will not delve into the aforementioned subjects at all, it is useful to understand that most (if not all) currencies are based on an inflationary model.

What Does it Mean?

For Bitcoin, the halvening is celebrated by the crypto-faithful. Parties and informal gatherings take place around the world, price predictions run rampant, and traditional news outlets barely pay it any attention. In some respects, the 2016 halvening was responsible for the 2017 crypto bull market that saw the price of one Bitcoin reach for $20,000. Does this mean we will see a similar price pump? Probably not. And here’s why.

To the Charts!

Prior to 2016 Bitcoin was boring. Unless you were a cyberpunk, lurked on Reddit, or already in the gold market, you’d probably never heard of it. The cryptocurrency had already been through one complete market cycle, or crash cycle. It had soared from sub-$200 to $1,200 before dropping back down below $200.

Up to the halvening Bitcoin saw a slight bump in price, reaching $800 before dropping back down. Immediately after the halvening, the price dropped to below $500 and everyone decided that Bitcoin was dead.

Pundits were claiming that the halvening was “priced in,” or that the market had already factored the halvening into the price of Bitcoin. And from the above graph, things did not look well.

However, markets are not rational beasts. The market is made up of people, and people are driven by emotions. Even automatic trading algorithms that were created by people operate with those inherent biases. As time passed, the story slowly started to change. So slowly, in fact, that a great number of people left the cryptocurrency market altogether. It took nearly a year for the effects of the halvening to show up in the charts. But when it did, it showed up with a vengeance.

That drop in July doesn’t look so bad anymore in comparison. And the all-time high of $20,000 makes it look like a smoking buy.

So . . . Buy Now?

Not so fast. We need to remember that the 2016-2017 cryptocurrency market was completely different than it is now. Back then ICO’s were raising millions of dollars on a half-baked idea. There were nearly zero regulations regarding cryptos and the IRS was still scratching its head over the “Magic Internet Money.” There were so few ways to short Bitcoin and zero ways for institutions or “Big Money” to be involved.

Currently, there are regulated Bitcoin futures products with derivatives on the horizon. Congress is actively looking into new crypto regulations and the IRS is allocating considerable manpower to help tackle the issue. In many ways the landscape is so different, I would not be surprised if it took longer than a year for the effects of the halvening to be felt. It is also a possibility that the price of Bitcoin is being manipulated from the shadows by people who do not have your best interests at heart. This speculation is one aspect that has kept the Bitcoin ETF (Electronically Traded Fund) from being approved for the past 7 years. Yes, the Bitcoin ETF has been struggling to reach approval since 2013.

Regardless, the ecosystem has changed substantially from the last time a halvening occurred. Of course, Bitcoin is a creature unto itself. Sometimes it’s digital gold, sometimes it’s a safe haven, and other times it seems to pump/dump for no reason. Plan accordingly.

Tytan's Top 10 Weekly Reads

In this section, Tytan has listed the top 10 articles that he believes to be the most impactful to your learning.

1) Bitfinex/Okex are attacked by a Distributed Denial of Service (DDOS) attack simultaneously: https://cointelegraph.com/news/crypto-exchanges-okex-and-bitfinex-suffer-simultaneous-ddos-attacks

2) Stock markets experience the worst week since the 2008 financial crisis: https://finance.yahoo.com/news/stock-market-news-live-updates-february-28-2020-234447699.html

3) FED will speed up cutting rates to combat CoronaVirus: https://finance.yahoo.com/news/fed-chair-powell-tools-support-193923349.html

4) Over the last 3 years, counterfeit Gold has entered the market: https://www.reuters.com/article/us-gold-swiss-fakes-exclusive/exclusive-fake-branded-bars-slip-dirty-gold-into-world-markets-idUSKCN1VI0DD

5) Many cryptos have held 200 moving average after fall: https://cointelegraph.com/news/price-analysis-feb-28-btc-eth-xrp-bch-bsv-ltc-eos-bnb-xtz-link

6) CEO’s make record-setting exodus in 2019 and January 2020:

7) The entire treasury yield curve is inverted: https://www.zerohedge.com/markets/entire-treasury-yield-curve-inverted

8) $6 trillion wiped off the stock market in 6 days: https://www.msn.com/en-us/money/markets/global-stock-markets-have-lost-dollar6-trillion-in-value-in-six-days/ar-BB10wiI7

9) Turkish short-selling halted on nations best performing stock: https://www.zerohedge.com/news/2017-05-29/turkey-bans-short-selling-online-trading-nations-best-performing-stock

10) Toronto exchange halts trading because of technical difficulties: https://globalnews.ca/news/6604854/toronto-stock-market-halted-technical-issue/

LunarCrush’s Crypto Data for the week

Despite the price of Bitcoin plunging with most of the crypto markets, the Galaxy Score has bumped back up. We could see a recovery in Bitcoin if sentiment remains positive

Image from (LunarCrush.com)

— The Global CryptoCurrency Volume Over the past 24 Hours is approximately $51.3M.

— The Bitcoin Dominance by market cap is approximately 64%, with 71 days towards the halving.

— Social Online Market-Sentiment reached 73% positive, related to almost 180K social media posts.

QR Codes - The Case For Going Paperless

Compared to nearly every country I’ve visited, I only now understand how cash-dependent America is.

I didn’t realize how almost all the other countries have abandoned the antiquated paper money system. Instead of using debit cards they scan QR codes or have gone completely contactless with their payment systems. While America was playing catchup with Europe’s “tap pay” cards, QR codes were quietly forging their own path, essentially dominating payment systems for Asia. Case in point; in China, WeChat / AliPay are almost a necessity. In SE Asia, Grab Pay (the Uber of SE Asia) and Gojekis are nearly ubiquitous.

As an American, I’ve only used QR codes once, when they first came out and you had to download a special app just to read them. I now use crypto nearly full-time. QR codes are the most convenient way to send and receive crypto payments because you wouldn’t read out a 26 digit string. Instead, you just scan the little square QR code.

In fact, before traveling, I was ignorant of Asia's adoption over QR codes. Europe has been opting for more established vendors such as Visa tap pay.

The fact that the majority of all my purchases require me to touch unsanitary surfaces such as a keypad or passing along nasty paper dollars is mostly an American problem, and in hindsight, pretty shocking.

What's more shocking now is the risk of a global pandemic. An entirely new generation of germaphobes is near panic, and maybe rightfully so.

So what’s next for America and going touchless? Well, it might be too late. We're too stuck in our ways because the fact that Visa or Apple Pay hasn’t built a mobile payment QR App blows my mind. It further shows maybe we're just too accustomed to inserting cards and passing along paper money.

In comparison to the established and aging demographics of America's economy, many countries are skipping debit and credit card networks entirely and jumping from cash and coins directly to Mobile Payments.

There's a saying I heard that relates to developing countries and their “leapfrogging” legacy technologies:

In Africa, they went from no phones to cellular phones. By the time cell phones came out, there was no use for Africa to burry phone lines across the continent, they jumped straight to cellular towers.

This technology leap I predict we will see happen more and more as more countries "come online."

So back to Mobile Payments, skipping the dirty cash, and pointless Debit Cards, so this is good right?

Well, here’s something to think about.

When you pay with cash, especially a nominal amount, the transaction is by default private.

I buy a coffee, it's private.

I buy a hot dog on Bourbon Street, it is private.

Cash works especially well when traveling when you or the vendor’s internet doesn’t work! Cash doesn't care what the strength of the Wifi signal is.

This has happened many times. A fond memory is buying chips, beer, and sunglasses at a dock in Thailand waiting to go to a Ko Pha-Ngan full moon party!

So that brings me to 3 next issues that I have with Mobile Payments,

They don’t work when power is out

Needs internet

Big Brother has a record of every transaction.

To touch on point 3, with mobile payments such as WeChat, AliPay, and others, you are intrinsically linked to your name, and the ability to be de-platformed is VERY high. Say the wrong thing online? De-platformed. Make a “bad” youtube video? Demonetized.

The cool thing about Bitcoin is you cannot be de-platformed. Every transaction, hypothetically, can be done pseudo-anonymously. You can be kicked off a Bitcoin Payment Interface Provider, I.e Coinbase, Kraken, Cash App, but you can never truly be kicked off the Bitcoin global network, which is something very liberating. And they have a satellite network.

This gives the peace of mind that, at any point and time, you can, spin up a new wallet and be on your merry way. NICE!

But I digress. There are big cases to be made for commutable diseases, contactless payment systems, and getting rid of paper dollars. But let’s not be too hasty!

We Need To Maintain Some Sense Of Pseudo-Anonymity

Online/Mobile Payments Don't Work With No Internet

“Touching” Money Is Something That Won’t Easily Go Away

So . . . before you go cashless, let's make sure we have a payment system that doesn’t allow for blacklisting or de-platforming political dissidents, which is where crypto comes in. As in this, and all things, the more options you have the better.

In my opinion, the future of payments will be a combination of:

Stable Coins

Digital Dollars (provided by the Federal Reserve)

Fluctuating Crypto-Currencies like Ethereum

Centralized “Big Brands” like Libra or Paypal.

I think it is very important we allow as many payment options as possible because when exchanging value, we should never feel constrained.

The world of money, and finance, is changing rapidly, and the people of the world demand global remittance and settlement, so while I do believe in borders and nations, I think currencies, will have to become Global or die. The digital economy demands it, and necessity is the mother of invention.

For me, I’ll always be a fan of having a stack of cash, some gold and silver coins, a loaded debit card, and a crypto wallet, because you never know what you’re going to encounter. Plus being prepared for a global pandemic in 2020 just feels great. And while we're all going cashless, germ-less, and wireless, let's make sure big brother isn't breathing down our next the whole time.

(Image)

This newsletter, analysis, research, and commentary provided by Modern Markets, lead analyst Kaltoro, with contributions from TytanInc and Digital Lawrence. The publication incorporates data from numerous sources including, but not limited to, CoinMarketCap, Bloomberg, CNBC, Lunar Crush, and the team at FomoHunt.

This newsletter is incorporated into the Weekly Modern Markets Podcast available on iTunes, Spotify, Anchor, and Stitcher.