Make sure to check out this week’s podcast episode with Joe Roets from DragonChain to discuss Hybrid Blockchain Tech at Anchor.FM

Modern Markets is deeply interested in the stories of readers and how COVID-19 has affected their daily lives. Please reach at modernmarketsinfo@gmail.com if you or someone you know has been directly affected.

NOT FINANCIAL ADVICE

Coronavirus (COVID-19) Updates

Coronavirus (COVID-19) Updates:

Stats via Johns Hopkins, Confirmed Cases - 4,629,575 Total Deaths - 311,425 Total Recovered - 1,619,613 - Mortality Rate - 6.7%

“If we fail to develop a national coordinated response, based in science, I fear the pandemic will get far worse and be prolonged, causing unprecedented illness and fatalities.”

- Dr. Rick Bright, Whistleblower

Round the World in Markets

North America

The Tesla CEO, Elon Musk, has threatened to move its headquarters and production out of California following new rules from Alameda County. The argument originated after stay-at-home regulations were extended to the end of May while Elon wanted to open up sooner, which he has. Moving out of state would deprive the city of Fremont of the millions of dollars Tesla pays in taxes, a harsh blow at a time when tax revenues are already down.

The new headquarter picks appear to be either Texas or Nevada, both of which have courted Tesla in the past. Nevada is also where the Tesla Gigafactory is located. A lawsuit is pending.

Members of the Trump cabinet are in quarantine after a staff member tested positive for COVID-19. Most visible of those affected is Dr. Anthony Fauci, a vocal proponent of social distancing and sheltering in place. Dr. Fauci is in a “modified quarantine” after being in “low risk” contact with the infected staff member. Staying at home did not keep Fauci from testifying before Congress, urging the states to remain closed until they can adequately implement testing and handle a new surge of cases. "There is a real risk that you will trigger an outbreak that you may not be able to control, which in fact, paradoxically, will set you back, not only leading to some suffering and death that could be avoided but could even set you back on the road to try to get economic recovery."

South America

Oil tankers from Iran have reportedly embarked for Venezuela. The Marine Traffic monitoring service has been tracking one ship, Forrest, though it cannot accurately say which country is its destination. While Venezuela has massive oil reserves it’s processing capacity has been hampered from international economic sanctions. Tehran has been accused by the US Special Representative Elliott Abrams of supplying oil refining equipment to Venezuela in return for gold. Tehran has denied the accusations and instead accused the US of attempting to overthrow the Venezuelan President, Nicolas Maduro.

European Union

The UK has announced conditional re-opening. Speaking to the press, Prime Minister Boris Johnson has outlined the steps to open England back up to business. Highlights include strongly encouraging people to go back to work if they are unable to from home, work from home if you can, practice social distancing, and to “stay alert.” Depending on the infection rate some hospitality businesses may be able to open in July. Boris Johns previously opposed lockdowns before changing his position after being infected and recovering from COVID-19.

Africa

We may see new connectivity to Africa in the near future. Facebook along with a conglomerate of telecoms are constructing an undersea cable to increase internet access to Africa and the Middle East. Expected to go live in 2023 or 2024, the 22,000-mile cable will allow faster and more reliable communication with other countries. Undersea cables are the most practical way to distribute the internet worldwide, as satellites generally have slower speeds and have diminished capacity.

Asia

Hong Kong struggles to open up businesses while containing the coronavirus. Protests have begun anew. Originally pro-democracy demonstrations, the protests quickly gathered international attention and a renewed interest in the semi-autonomous city. A territorial business hub Hong Kong has taken an aggressive stance on the coronavirus. While it has taken great strides to invite businesses back, a recent resurgence in the virus threatens future expansion.

China accuses the US of “lies” and “preposterous allegations.” The Chinese government has devoted considerable resources to refute allegations that it withheld information from the US and that the virus originated in a Wuhan laboratory. Recent statements by President Trump have reiterated that China is responsible for the virus. The contention could put the trade deal with China in jeopardy as tensions rise. Finalized in January, the current trade deal has China purchasing $200 billion worth of US goods over two years as the US lowered tariffs on Chinese imports.

Opening the Economy Up - Op-Ed

(Image Courtesy: FrenchPress)

10 weeks of quarantine appears to be the threshold for American tolerance. Despite warnings from health experts both local and international, multiple states and counties in the US are beginning to open up due to increased pressure and worries about a continued loss of workers’ income. While the job loss and closure of multiple industries has devastated local businesses, the cost of the economy must be weighed against the real cost of human life.

Here are the current facts:

There is not enough testing capacity for COVID-19. To date, we have done 28 tests per 1,000 people, or 2.8% coverage. To accurately predict future infection rates/containment we need more testing.

The virus continues to mutate, making a vaccine potentially more difficult to create.

Companies are hurting badly. Over 100,000 have shut down permanently.

The peak of infections may be over, but we are still a long way to a solution.

Opening businesses back up will result in increased infections, most likely putting us back on a parabolic trajectory.

Though a solution to the virus is an ever-changing moving target, some states have decided to re-open businesses. Georgia has been a vocal proponent of returning “back to normal” after allowing non-essential businesses like salons, gyms, and movie theaters to open up in late April. The elderly and medically “at-risk” are still required to remain home.

Georgia is serving as a case study for the reopening process. The Atlanta Journal-Constitution (AJC) is reporting that the rolling average death rate in Georgia is leveling off or beginning to drop off, although it is quick to remind that the data is two weeks behind, as that is the current incubation rate of COVID-19.

(Image Courtesy of AJC)

Georgia also has an updated calculation of the Rt (R naught), or the transmission rate of the virus. The Rt is a measure of how easily the virus is transmitted, the higher the R naught is, the more people an infected individual can spread the virus to. Any measurement larger than an R1 grows the infection rate, and less than R1 means the infection is shrinking. As of May 10th, the Rt is 0.96.

Popular opinion seems to be that if the R naught is going down, then now is the perfect time to re-open the nation. This assertion is incorrect. In the same way that patients on antibiotics need to continue taking them after they begin to feel better, our states should remain closed until there is at least a way to consistently treat the virus. Failing to have a solid plan for re-opening businesses is a massive oversight on a national scale.

Currently, the nation’s plan to allow people to go back to work is this: Nothing. There is no national plan. At one point there was a plan from the CDC but it was quickly slapped down on April 30th before issuing its own guidelines. The plan in full can be viewed here. One standout recommendation is a ban on all non-essential travel until we have 42 continuous days of declining new cases of the virus. This differs from the White House’s own recommendations to minimize non-essential travel. The document also places a strong emphasis that new infections will likely spike after businesses reopen.

Sen. Charles Schumer of New York is one of the growing numbers of legislators who want to see stronger leadership and responsibility. He stated on Wednesday “America needs and must have the candid guidance of our best scientists unfiltered, unedited, uncensored by president Trump or his political minions. The CDC report on reopening the country is an important piece of that guidance.” Part of that guidance surely includes accurate testing. The Harvard Global Health Institute reports that the national testing capacity is currently maxed out at 250,000 daily tests, though we need to reach 900,000 daily tests to cover those in need. The same report goes on to state that Georgia, Florida, Texas, and Colorado all lack the necessary testing capacity to safely reopen.

The scientific evidence points to a sharp increase in COVID-19 infection cases if the nation reopens. The University of Washington has increased its projected death toll to 137,000 deaths by August while a combined study (ensemble model) from the University of Massachusetts Amherst estimates the total deaths by June 6th to be 110,000. For comparison, this is 2x the capacity of the Allegiant Stadium in Las Vegas.

As a macabre thought experiment, I decided to calculate the loss of income compared to the value of human life.

Statistically speaking the average cost of the life of a US resident is $8 million.

Goldman Sachs is projecting the US GDP to shrink by 34% in Q2.

Compared to the $21.34 trillion GDP in Q2 of 2019, this represents a loss of $7.26 trillion.

$7.26 trillion GDP losses divided by $8 million per human is 907,500. In other words, close to a million people could be eliminated to make up for the drop in US revenue or, we can justify the loss of ~1 million lives if we reopened tomorrow. I’m sure some economist working on capitol hill has run similar numbers, but I have yet to read anything about it.

These thought exercises may become a moot point as the stock market continues to rally. As Forbes explains it, most people are conditioned to believe that stocks go up in a good economy and down in a bad economy. If the economy is doing well there is more capital available to put towards risk-on assets like stocks. When stocks go up as the economy goes down a large amount of cognitive dissonance occurs in those who pay attention to these things.

How do we reconcile this? A combination of low-interest rates, influential companies like Amazon and Netflix posting positive Q1 results, and bond ETFs being bought up by the FED appear to be supporting the current markets. As long as these index-listed companies continue to thrive and outpace blue-chip companies like Ford and GE, the Dow and S&P will continue to rise.

These new higher-highs completely disregard the growing unemployment claims which could be as high as 20% in the near future. Will these newly unemployed people simply wait for another round of stimulus? Find other jobs? Protest their local governments with open-carry firearms?

Only time will tell as we continue into these uncharted waters. Even if states open businesses back up and we proceed into the “new normal” there is still a second wave of infections to deal with, and possible future shutdowns.

BTC Post halvening recap

(Image Courtesy of: Fortune)

The Bitcoin halvening has come and gone. Adept readers from last week's edition may be wondering “What happens now?” The short answer is: business as usual.

The Bitcoin price dropped going into the halvening but has recovered nicely, sitting around $9,500, up from $8,100 last week. The hash rate, or measure of Bitcoin’s computing power, saw a slight dip but appears to be in line with the moving average.

The resilience of the Bitcoin price has brought forth a new wave of price predictions. Raol Paul, CEO of the financial interview site Real Vision, says that $467,000 for Bitcoin is an achievable number if it becomes a complete ecosystem. Others have perked up following the halvening. Hedge fund manager Paul Tudor Jones announced he is putting 1% of his sizable fortune into Bitcoin as a “hedge against inflation.”

Digital Dollar

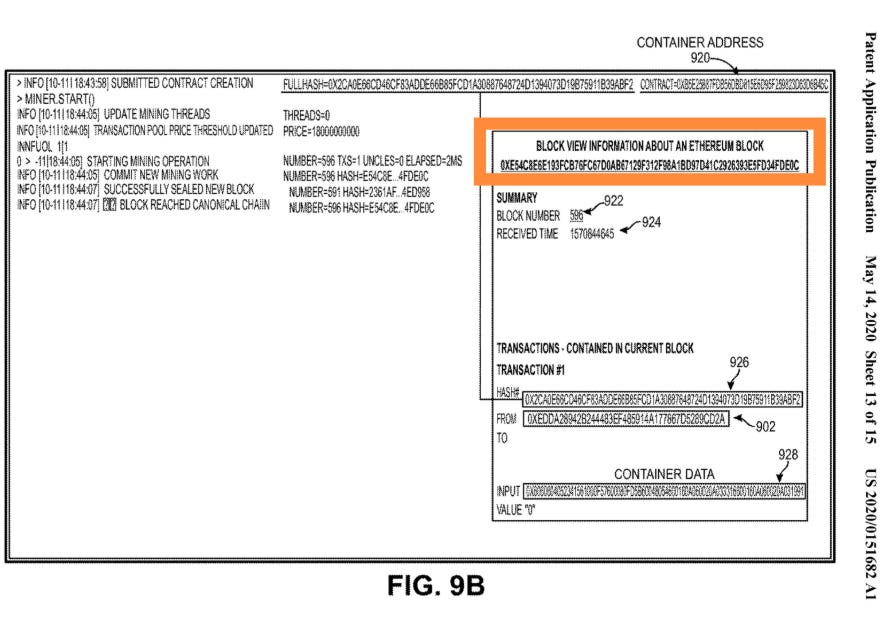

The idea of a Digital Dollar refuses to die. The US Patent office recently made public VISA’s plan to implement a digital dollar on the Ethereum blockchain late this week. The proposal would digitize not only the dollar but other Central Bank Digital Currencies like the yen, euro, and pound. As we have previously reported there have been several pushes in Congress to introduce a digital dollar amidst the COVID-19 pandemic, though none have been passed to date.

The specifics of the proposal include using a blockchain, plurality of blocks, and private and public keys. A deeper dive includes reference to the Ethereum blockchain, a popular platform used by thousands of other decentralized applications (DAPs).

Aside from being faster and operating 24/7, a digital dollar would eliminate physical currency, which has been confirmed as a carrier for COVID-19.

While the digital dollar gains momentum, Facebook’s Libra is slowly chugging along. The Libra hit multiple setbacks as many of its founding partners decided to pull out, including VISA, Mastercard, and Paypal. Other tech giants have stepped in to take their place of late. Temasek, a Singapore-based investing company, is joining the Libra Association, as is the private equity firm Slow Ventures.

Libra recently released a new paper detailing how it will change to better comply with international banking regulators. It will still be backed by several currencies and provide an open network for bank participation, but will also institute four different certification levels to ensure money laundering does not take place. Transaction limits, KYC/AML requirements, and modified financial “relief valves” will all work to maintain the value and cross-platform compatibility. As stable coins and Central Bank Digital Currencies become more popularized, we may yet see the Libra project see life.

Kaltoro

@kaltoro_

This newsletter, analysis, research, and commentary provided by Modern Markets, lead analyst Kaltoro, with contributions from TytanInc and Digital Lawrence. The publication incorporates data from numerous sources including, but not limited to, CoinMarketCap, Bloomberg, CNBC, Lunar Crush, and the team at FomoHunt.