Round the World in Markets

North America

US stocks and treasury bonds pulled back and gold surged as fears of the coronavirus continue to grow. Crude oil is down as well. We may be moving into a risk-off climate until the rate of infection of the global pandemic slows down or a cure is found.

South America

Nike has made the announcement that it will be partnering with specific South American distributors in order to sell directly to consumers. Grupo Axo will be taking over operations and distribution in Argentina, Uruguay, and Chile. Expected to begin in Q3 2020, this shift in Nike’s strategy to bring new products to the market faster and boost online sales.

European Union

Spain has voted to adopt a digital goods tax in December of 2020. This would apply to all companies that make over $800 million a year or digital sales of $3.2 million a year. The planned 3% tax will be on digital ads and on sales consisting of user data. US companies affected will be Facebook, Google, and Apple.

The US initially threatened a 100% tariff on all imports from France before Paris agreed to move the tax collection to December.

SE Asia

Thailand is proposing a new economic stimulus package to combat the economic effects of the coronavirus. Minister Uttama Savanayana’s plan will include the sectors of tourism, consumption, and investment. Last year the Thai economy grew 2.4% though this year may see less than a 2% growth.

Middle East

Concerns amidst the coronavirus may cause a drop in oil prices if it persists into Q2 of this year. Should the infection rate peak in March recovery should follow shortly after. Countries like the UAE and Qatar have exposure to the Chinese market due to crude oil exports.

Coronavirus and Global Markets

The global stock markets have seen a tremendous rise over the last several years. Since 2009 the increase has been steady and consistent, with a sharp ramp-up starting in 2018. However, the recent headlines concerning the coronavirus (Covid-19) have some analysts concerned about a quick correction as businesses begin to scale back due to health concerns.

According to the World Health Organization, coronaviruses are a large family of viruses. These can cause mild flu-like symptoms while other strains are responsible for the more aggressive conditions including the SARS outbreak of 2002-2003. This most recent outbreak from Wuhan China, labeled 2019-nCoV, has created concern on a global level.

As of the time of writing Johns Hopkins places the global infection at close to 76,000 confirmed cases with 2,248 total deaths. Countries including the US, Japan, and Australia have begun initiating quarantine procedures for travelers coming back from countries with known infections. A recent discovery has shown that infected individuals can spread the virus before showing symptoms.

In Wuhan China, the origin of the virus, officials have taken the steps to quarantine the infected and spray disinfectant in public areas in an attempt to curtail infection. China has also begun physically disinfecting its paper money to reduce the spread of infection.

Market Reaction

The initial market response was subdued but the growing threat to public health is affecting supply chains for some of the world’s most influential companies. A lack of manpower can lead directly to shipping and production delays and a drop in revenue. Apple, who has large manufacturing plants in China, has shut down several of its stores and facilities in China amidst concerns over the virus. Apple CEO Tim Cook stated earlier in February that there were a number of mitigation plans in place to change its production to factories in unaffected areas. However, it has since released a statement lowering expectations on expected production and demand in China.

While most of the reported cases of the coronavirus are located in China, the ripple effect has been dramatic. Companies like Hyundai, Estée Lauder, Nintendo, and Delta Airlines have all expressed concern that sales will be affected until a solution is found. Over 421 companies are on record with similar statements on a slowdown in business.

National Public Radio’s Emily Feng reported that the GDP of China has been lowered by half a percentage point due to the expected slowdown from the virus. Half a percentage point may not seem like much, but with an expected 2019 GDP of $14.1 trillion dollars, these seemingly small fluctuations represent billions of dollars.

Despite these worries over the coronavirus, the US stock market has acted surprisingly resilient. The S&P 500 is still up over the last two months, from 2,348 in mid-December to 3,340 at the time of writing. There is a dip in the RSI on the daily and if the downturn continues next week we may see a return to the trend line.

The cryptocurrency market has not registered any hesitation over the last month. Bitcoin recently spiked to over $10,000 and altcoins seem to be following, with ETH and BNB also hitting local highs. Bitcoin has since dropped back to $9,700 . A sustained price level of over $10,000 represents a significant psychological threshold, one that may see a significant entry by the retail market.

While the coronavirus continues to dominate headlines we should be careful to not fall into fear-mongering. Until stocks make a sharp downturn the market appears to still be on the uptick.

Global Regulations

The US Plans New Crypto Regulations

The US regulatory FinCen (Financial Crimes Enforcement Network) announced that it is preparing to release new regulations regarding Bitcoin and other cryptocurrencies. Treasury Secretary Steven Mnuchkin spoke before the Senate Finance Committee and reporters earlier this month. He stated, “We want to make sure technology moves forward but on the other hand we want to make sure that cryptocurrencies aren’t used for the equivalent of old Swiss secret number bank accounts.”

What the Treasury Secretary may be referring to is enforcing the FATF’s (Financial Action Task Force) recommendation that all crypto exchanges retain and share customer information. This would include, but not be limited to, the customer’s name, location, and wallet ID.

Cryptocurrency and Bitcoin have long been heralded as the preferred payment method by criminals on “dark markets.” However, blockchain analysis companies like Chainalysis have shown that roughly 2% of all transactions using Bitcoin are illicit. Perhaps someone should relay this to Treasury Secretary Mnuchkin, who famously stated he did not believe “cash was laundered all the time”, or that it was used for illicit transactions.

$1,000 of Apple Stock bought when Steve Jobs came back to the company in 1997 is now worth over $645,000 when taking stock splits and dividends into account. How do you like them apples?

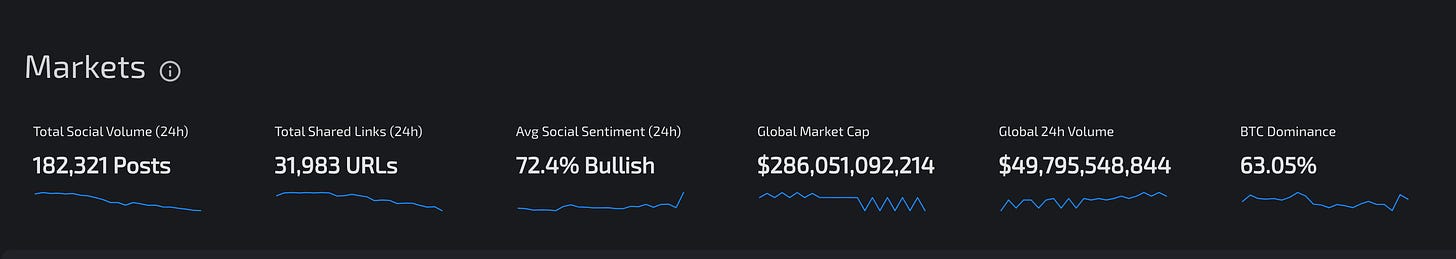

CryptoCurrency Market Data.

According to LunarCrush:

— The Global CryptoCurrency Volume Over the past 24 Hours is approximately $49.8M.

— The Bitcoin Dominance by market cap is approximately 63%, with 78 days towards the halving.

— Social Online Market-Sentiment reached 72% positive, related to almost 185K social media posts.

Bitcoin’s price poked its head above $10,000 earlier this week but only momentarily before heading back down to $9,700. The dropping Galaxy Score from Lunar Crush may signify that the price will continue to lag.

Bitcoin will need to move above the trend line to retain the bullish price trend. A sustained price below the trend is not good news for the short term.

Fintech Trends.

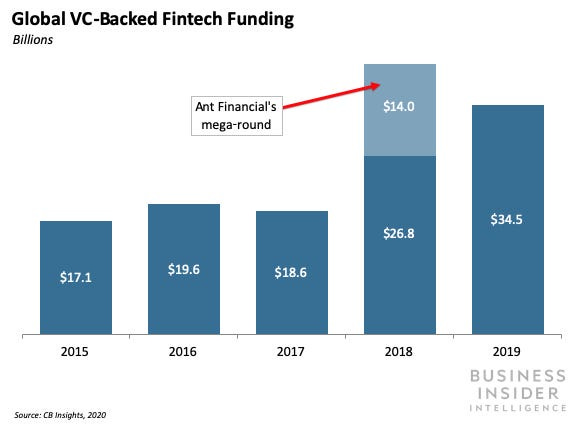

According to BusinessInsider:

— “Throughout 2019, fintech startups globally scooped up $34.5 billion in funding, according to new data from CB Insights. Excluding Ant Financial's unusually large $14 billion round in 2018, fintech funding was up nearly 30% year-over-year.” - Business Insider

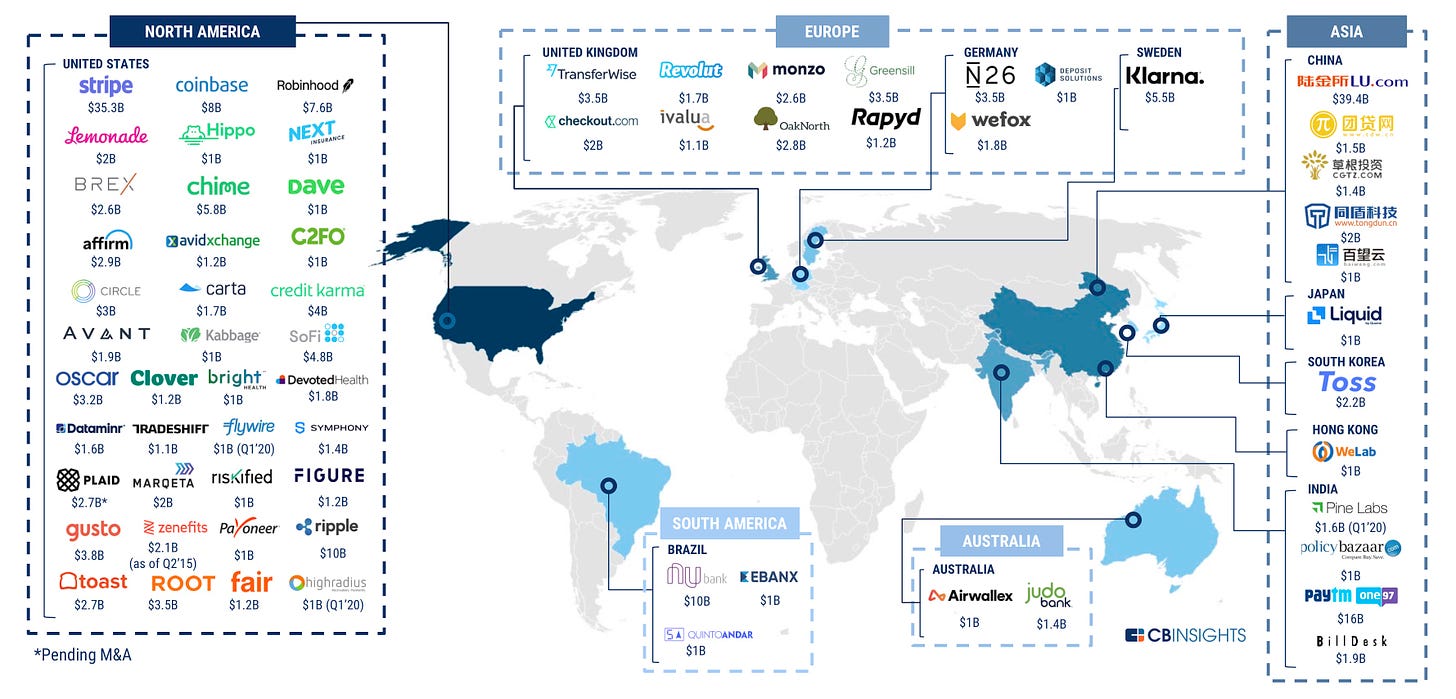

According to TechCrunch:

— “Emerging and frontier markets were at the centre stage of the most of the action: South America, Africa, Australia, and Southeast Asia all topped their annual highs last year.” - TechCrunch

- “Emergence of 24 new fintech unicorns in 2019: 8 fintech startups including Next Insurance, Bight Health, Flywire, High Radius, Ripple, and Figure attained the unicorn status in Q4 2019, and 16 others made it to the list throughout the rest of the last year.” - TechCrunch

Crypto in 2020: What is it Good For?

In all honesty this is a doozy of a question. First and foremost, I still feel that the first killer use case of crypto is sending payments globally - uncensored. The ability to send out a payment to anyone, anytime, for any reason, and not be grilled by your financial institution, is compelling. This will become quickly clear If you’ve never been without access to your debit card or a payment is put under review, but you had a mobile crypto wallet.

My Bitcoin Story:

I was in Vietnam (Saigon/ Ho-Chi-Minh-City) two summers ago, landing at 9pm, got to the ATM and BOOM, no debit card. I left/lost it in Indonesia. It’s a scary feeling to be in a foreign country and not have any money at all. There’s no place you can go and say “Oh I’m an American citizen, can I borrow a few hundred until I'm home? I promise I’m good for it!”. Haha. So, there I am no money, no hotel, no food. What does one do?! Aha- Western Union to the rescue!

I convinced a taxi stop to take me to the walking district, around 30 mins from the airport for free, with the promise of payment upon arrival. It took a few minutes and a few taxi stands, but I got one. Luckily the stand operator spoke good English, but the driver didn’t. We take the journey and land at Western Union at 11pm, exhausted but with my bags. I walk upstairs, and of course they’re closed.

At this point, I’m kinda panicking. Not only does the taxi driver seem upset, because I motioned that there was “no money” for him, he also had my bags ransom. Even if I ran to get them out of his car, I’d be a criminal, with nowhere to sleep. Hmmm? What should I do? In a surreal moment, I spotted a GLOWING BITCOIN emblem. I’m HOME!

I run downstairs, and what do you know? I didn’t even realize when I first walked in but I’m in Vietnam's crypto cafe, on a bustling Friday night. I immediately feel joy and find someone who works there, tell them my situation that I need to sell Bitcoin ASAP! He says, "Oh no worries, head right back upstairs". And again, I didn’t notice before, but there’s a BEAUTIFUL Bitcoin ATM. My data was spotty so I hopped on a Wifi Network with the owners help, clicked on a VPN, and sent the Bitcoin.

Now we wait.

While this is going on, my Taxi driver was growing more and more irate, and rightfully so! I’m impending his business and keeping him waiting. As I’m waiting for the transaction to post, I explain my situation to the bar's owner, and since he understood that I’m part of this global “group of weirdos” that use Bitcoin, he welcomed me with open arms and told me his story of traveling the world, settling down in Vietnam, and how his entire life changed with Bitcoin.

He clapped a hand on my should, smiled, and said "No worries son, I’ll go speak to the taxi driver, and get you a beer". Before I knew it this man was paying the Taxi driver for me, around $10 USD and another $10 USD in a tip for the troubles. I was so thankful to no longer be under the gun with this Taxi Driver who took a risk driving me. My bags are in the bar, and I’m drinking an ice-cold beer, sharing stories of the past.

Luckily, I made a crypto friend last time in Vietnam and she happened to be in town. We had a few beers, celebrating my bad/good luck. I got a notification on my phone after some time that my cash was able to be withdrawn! Haha - nice! I paid the inn-keeper the bar bill, the taxi bill, and a little more for his troubles and kindness. At that moment I realized the world can be a very giving place, and that technology can bring us all together. Also, how difficult life could have been for me waking up in a Vietnamese jail.

Travel and crypto are intrinsically linked in my mind forever as, because during my 14+ months overseas, it was a primary means of receiving and sending funds. The great thing about it was I never got a notification from PayPal or banks, saying this transaction is under REVIEW. The dreaded review process can be a death blow for any person, business, or enterprise. With this confidence in a decentralized global network for payments, I look forward to crypto’s next killer features because I’m sure it’s going to be something great.

^^ This sport court is located blocks from the Vietnam Crypto Cafe^^

This newsletter, analysis, research, and commentary provided by Modern Markets, lead analyst Kaltoro. The publication incorporates data from numerous sources including Bloomberg, CNBC, Lunar Crush, and the team at FomoHunt.

This newsletter is incorporated into the Weekly Modern Markets Podcast available on iTunes, Spotify, Anchor, and Stitcher.

Modern Markets Ep1: Corona Virus, Crypto Regulations, and the worlds markets