(BONUS) Modern Markets Episode 3.1: Social Data Analytics on the Coronavirus and Markets

March 11th, 2020, by FomoHunt

By Kaltoro

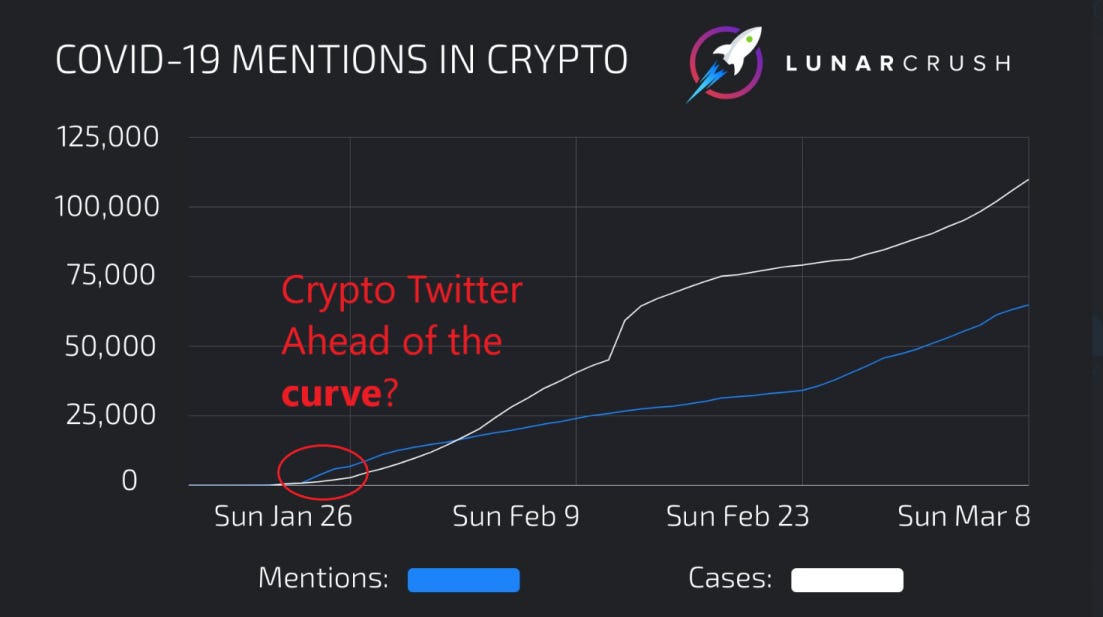

In the three months that the COVID-19 virus has spread over China and the globe, several interesting data points have surfaced. The social media aggregator, LunarCRUSH, has released data graphing the mentions of the coronavirus on Twitter. Specifically, they surveyed individuals interested in cryptocurrency and blockchain. Anyone posting about any of the 2,000+ cryptos/tokens was taken into account. The sample size is approximately 63,000 posts.

LunarCRUSH collected the number of mentions of “Covid-19, Coronavirus, Corona virus, Covid-19, Covid19, Covid_19” since the beginning of the outbreak. The graph represents a snapshot of emotional sentiment.

As explained by Jon Farjo - Founder and Chief Product Officer @lunarcrush:

“Crypto is driven by the community. It’s our mission to build trusted, actionable insights that inform community members and allow them to make the best investment decisions possible. In these times of global uncertainty and fragmented information, nothing is more important than trust. We hope our platform can help play an important role in that.”

Before the COVID-19 outbreak, most information was delivered via the mainstream media. In the age of Twitter, information travels exponentially faster and without the filter of a media conglomerate. As such, large datasets now exist that allow us to chart and follow mentions, engagements, and sentiment on these specific platforms.

Discerning the Data

On the initial viewing of the data, we see that the mentions of COVID-19 rise over time in correlation with the number of confirmed cases. No surprise here as one would expect mentions to increase as the contagion spread. What is surprising is the abnormally high concentration of mentions at the beginning of the outbreak. The volume of mentions (VoM) also extends despite the number of initial cases remaining low.

Again from Jon Farjo:

“We noticed an uptick in coronavirus-related posts across crypto users continually increase over the past few weeks so we took a deeper look. Not surprising to us was the huge amount of posts we’d uncover. What was surprising was just how very early the posts were.”

Furthermore, from February 9th to February 23rd there was a sharp increase in infection cases, yet Crypto Twitter showed a small increase in mentions. This could be because a large section of crypto enthusiasts had already tweeted about the virus early on, or previously expressed their opinions. This is not surprising as people involved in the blockchain may be looking years ahead in time, choosing a longer time preference vs. a shorter time preference.

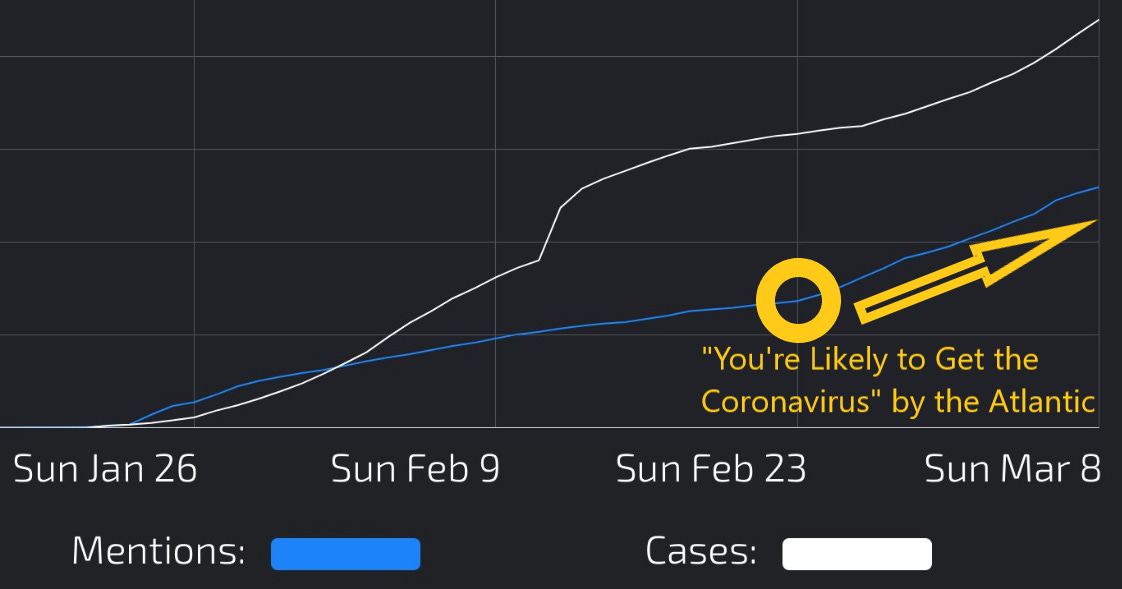

On February 24th, the Atlantic posted an article titled “You’re Likely to Get the Coronavirus.” This seems to coincide with the VoM increase of Crypto Twitter, as it became more aware and interested in the virus.

Bitcoin Reacts

The concern caused by the virus has caused the Bitcoin narrative to quickly fall from the “safe haven” narrative that was popular months ago. It appeared that Bitcoin was positioned to be Gold 2.0, or a way to store value during times of uncertainty. This has changed nearly overnight as the price of Bitcoin has dropped from $8,400 to a low of $7,682 from 1/26 - 3/9. It is clearly acting as a “risk-on” asset or an asset that decreases as market volatility increases.

On February 20th, the price of Bitcoin was over $10,400 at a point when COVID-19 cases were peaking in China. The price then dropped dramatically, most recently on 3/7, with a drop from $9,200 to a low of $7,633.

The impression from the chart is that traders were buying up Bitcoin as the panic began, only to sell off as the US and other nations began to admit how severe the outbreak really is.

Twitter philanthropist Bill Pulte set out this tweet on Feb 28th, as Twitter began building steam. He quickly deleted it.

If he did indeed buy more Bitcoin, I hope it wasn’t on margin.

Many on Crypto Twitter were caught unaware by the sudden drop, although it could have been forecasted as the S&P 500 gave up months of earnings in record time. From February to March, the S&P 500 plummeted from 3,400 to 2,747, the largest elimination of value since the banking crisis in 2008. Ironically, the writing of this article marks the anniversary of the exact bottom of the stock market 11 years ago: March 9th, 2009.

Financial manager, and Raven Coin supporter, Bruce Fenton, has been tracking the progress of the virus extensively. His Twitter timeline is packed with links and figures on a nearly hourly basis. With a background in financial planning and system analysis, Bruce has been vocal in his concern, so much so that he put contingency plans in place for his own firm in mid-February.

And on February 23rd, Bruce tweeted

“I’ve noticed a massive difference in how much people who deal in risk care versus those who don’t on #Covid_19. My VC & Wall St trader friends are prepping like mad. My friends who work for bureaucracies just sort of shrug, waiting for someone else to tell them what to do.”

Moving Forward

The data coming out of LunarCRUSH is in constant motion as new cases, and tweets, continue to emerge.

The world is watching very closely at how sovereign nations are handling and adapting to this new paradigm of a global outbreak.

How long the virus takes to run its course is, at this point, uncertain.

What IS certain is that no matter what happens, we at Modern Markets will be here to deliver our continual analysis and interpretation of this data as the situation unfolds. - Kaltoro

Tytan’s Top 10 Weekly Reads

In this section, Tytan has listed the top 10 articles that he believes to be the most impactful to the global markets.

India lifts crypto trading Ban temporarily, but the danger still looms.

Bitcoin conferences across the U.S. cancel, or delay because of CoronaVirus

A CoronaVirus Recession could cause S&P to fall to $2450 by year end

The Conference is Cancelled

By Digital Lawrence

I’ve received this email quite a few times over the past few weeks.

“Due to health concerns, the conference has been postponed/cancelled.”

It’s easy to empathize with organizers, as conferences have loads of sunk costs in these events. These funds are difficult to recuperate, and conference attendees and sponsors are often out of luck as well. Hotels, Flights, and other travel-related costs are often non-refundable.

Just to name a few conferences that have canceled recently:

These cancelations have made me ask a couple of questions:

How big is the conference economy?

Can we go remote?

Will this change modern behavior?

Someone should build Zoom for full remote conferences, and do it right now. - Balaji S. Srinivasan.

Networking around the globe for the past 24 months has been my specialty. I have attended conferences in such countries as Japan, Korea, England, and many more.

The human connection at these networking events is often overlooked. There is undeniable value to looking someone in the eyes, sharing some laughs over a smoke break, or shaking someone's hand (I know it sounds gross now). At a base level, I think humans will always desire to be around other humans, and not just communicate through a screen. As a species we have operated without electronics and thrived on interacting with our fellow humans.

With conferences going completely remote, where does all the extra money go? From anecdotal experience, one would spend between $1,000-$3,000 for these extracurricular conferences during a 4-day conference.

If I remotely attend 3 conferences this week?

What do I do with the leftover money?

Does it go to Postmates, Uber Eats, VR Goggles?

At least temporarily, as the world economy shifts away from meetings in person, I feel it will be more difficult to stand out in the online crowd. It’s easy to walk up, sharply dressed, introduce yourself, and with a little charm get to know someone. Can the same thing be done through a screen? I think not.

These are implications for a remote society that we haven’t figured out yet. Remote work sounds cool, and people are pushing it, but what happens on a macro scale?

I wonder if this will become the health equivalent of 9/11, complete with new policies that shape our world post-2020.

Like 9/11 there were immediate behavior changes, including worries and scares, but the government stepped in and changed a lot of policy. We as consumers were left with quite a bit of new rules and regulations two decades later, i.e. TSA, DHS, no-shoes on the planes).

I feel the following will receive increased attention in a post-corona world:

Business Sanitation Policies

Global Health Standards

Vaccines

Work Leave

Telecommuting

I predict sanitization as a service becomes popular, because there is a lot more we can do as a society to keep germ transmissions smaller. I look forward to seeing if this catches on. I also see this as the catalyst to changing the paradigm with regard to several behaviors. like .

Touching your face - You just did it

Handshakes - The foot equivalent

Door Handles in Bathrooms - Now open with your foot

Office Work - Bubble Cubicles!

225 Pages of CDC Isolation Precautions - May be required reading for HR

The longer this crisis persists, the larger the chance of a very different “post-corona world” becoming a reality. Once the dust settles, there could be new societal norms, laws, and changes in the way we live our everyday lives.

I hope we make some lasting changes that improve the world, but also balance the human element. But if we go too far, we may find ourselves becoming just a little bit less human.